Not one week ago, Greece was granted

a final wish a new bailout worth $140 Billion (on top of last years $140 Billion bailout) which despite all of the drama, solved absolutely nothing. As we reported, this band-aid solution which hyped "the markets" into typical KoolAid hysteria, would eventually wear off and reality would once again come back to bite - ever harder, ever deeper. (

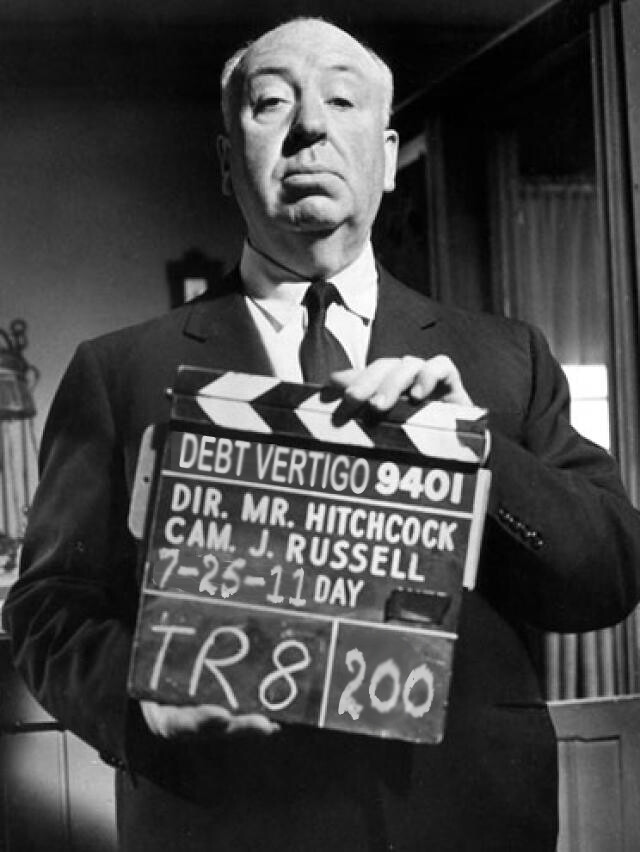

Thank you WB7 of ZeroHedge for the Hitchcock graphic!)

Sure enough, one week later, nothing has changed. Italian and Spanish bonds remain at elevated levels not seen since the inception of the EU and these levels are to be closely watched as investors doubt the solvency of the entire EU. Spain's 10yr continues to float just above the 6% threshold as does Italy's 10yr. We'll continue to monitor this rate and see what it predicts for the EU. On the heals of yesterday's moot Greek downgrade, Moody's noted that the new bailout would make it easier for Greece (exactly what the

last bailout was supposed to do) to reduce its debts but debt to GDP will remain "well in excess of 100 per cent of its GDP" for years. Again, as we have been highlighting since forever, ratings agencies are good for "after-the-fact" events, but as with the whole 2008 debacle, they failed to forewarn the whole world of the pending doom. That's why you have

Fiat's Fire!

In the meantime, the drama across the pond in the U.S. continues,

as Obama fights a Boehner over a debt ceiling increase. More theatrics, more smoke and mirrors, more bread and circuses for the masses. While you watch the continuing circus, we want you to keep this quote from a 2006 Obama in mind:

"The fact that we are here today to debate raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can not pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government's reckless fiscal policies. Increasing America's debt weakens us domestically and internationally. Leadership means that, "the buck stops here.' Instead, Washington is shifting the burden of bad choices today onto the backs of our children and grandchildren. America has a debt problem and a failure of leadership. Americans deserve better." - Senator Obama, March, 2006

What changed since 2006? Did debt all of a sudden in 2008 become

necessary to keep the pyramid scheme going? Did Obama become privy to new information?

You know, he was 100% correct when he spelled it out in very plain terms then - raising America's debt limit is a sign of leadership failure. It is a sign that the U.S. Government can not pay its own bills. It is a sign that we now depend on ongoing financial assistance from foreign countries to finance our Government's reckless fiscal policies. Increasing America's debt weakens us domestically and internationally.

We couldn't have said it any better. Now, with that being said, let's check the price of oil and the profits for the top oil companies. Oh, what a surprise! Record profits for the oil companies - and for Wall Street. But no soup for you, Main Street USA. Instead, you'll have to fight over the fewer and fewer jobs that Wall Street chooses to keep here. Remember, there is no quicker way for a company to cut costs than to cut jobs. Going "green" is costly in the short term but cost effective long term, so in this economic depression recession, they chose not to make that investment. What else can they do if they are to keep bonuses? How else can they keep this rigged casino operating for another month?

The bottom line - raising the debt ceiling or not is inconsequential in the long term. Period. Allow that to sink in.

If an agreement was reached tonight for example, it would only postpone one of two inevitable outcomes: 1) a U.S. default or 2) hyperinflation. We firmly believe they will choose hyperinflation as that buys them time, versus defaulting which would spell immediate disaster for them. It's a mathematical certainty.

Also certain, is the current U.S. cash burn rate (which has increased exponentially) will now only buy 6-8 months if the proposed $1.6 Trillion increase is passed, at which point they will have to decide to raise it again or not. Which is why so many Wall Street banksters "experts" are calling for abolishing the debt ceiling altogether, because they know, come 6-9 months from now it will need to be raised again. So if this giant scam global economy is to continue, that ceiling has to be abolished. If it's not raised, Wall Street's free money comes to an end. They can't have that now, can they?

Further, and this is the real kicker - any and all catastrophes (man made or naturally occurring) will be met with unprecedented fiat printing, which in turn equals more inflation for you and bigger bonuses for Wall Street. Which is certainly why immediately following the triple catastrophes of Japan in March, the talking bimbos on CNBS were celebrating this disaster. No joke. It was touted as "bullish for the economy," and one old filthy fleabag went as far as saying, "thank goodness the monetary toll is not as bad as the human loss." Remember that? Our blood is still boiling from that.

We will say, another major disaster such as the one in Japan, might just push oil up to $150pb and jump "real time inflation" from the current 11% to 18% or more. It's coming. Given 2011's record earthquake activity, our anti-Goldman HF data mining supercomputer is putting the odds of another major quake in 3 months time at 80%. And we're already 1/4 the way on a Level 6 GEES. Things are speeding up.

Fresh off the presses today is the

New Home Sales data which, (surprise, surprise) "

unexpectedly" dropped another 1% in June to a three month low, on top of last year's sales which were the worst recorded sales in over 50 years. Oops. June also now makes two consecutive months of "

unexpected" drops. Of course, Fiat's Fire readers are not surprised and this news is not unexpected. Only Wall Street's

finest found this "unexpected" as they awaken from their KoolAid induced comas. Then again, they also thought silver and gold were not monies, but traditions. We all know where gold and silver are today.

Updates

Update 3: Crude oil, back over $100. Very bullish for the economy. Or not. Got gold? Got radioactive-free Milk?