The next time you turn on your faucet and drink a glass of water, you might want to think about the people in Japan. Japan Times is reporting that radioactive water has been detected far from Fukushima in the Chiba and Saitama Prefectures as well as the city of Tokyo. This has led to a panic run on bottled water and this has many worried of the long term consequences and availability of clean drinking water.

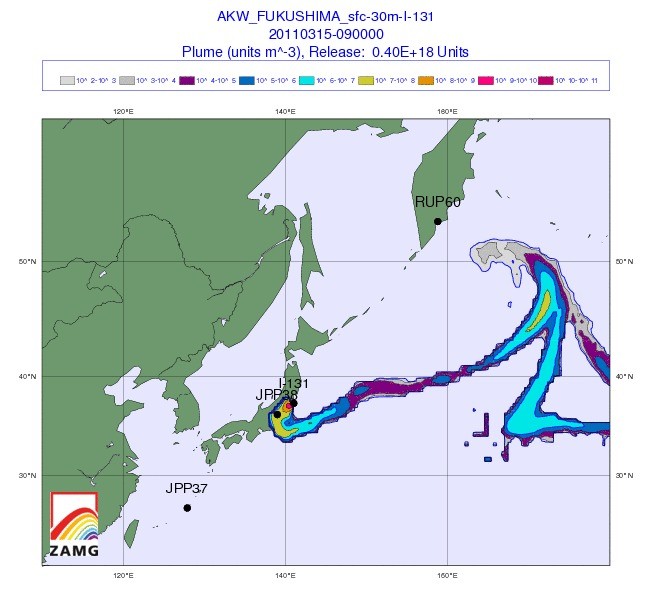

It doesn't look like anyone will be going swimming off the Eastern coast of Japan anytime soon. Radioactive iodine 147 times the legal limit has been discovered. Now, you can get a tan both in the water and out. The following image may help to explain why:

Not to be missed today are the rising temperatures in reactor 1 which have passed their max operating temperature by 200+ degrees, but also the salt coated rods exposed to the endless amount of sea water used to cool them. Somehow, we think they can't keep this going much longer.

Quickly jumping to a precious metal that I wrote two weeks ago you should keep your eye on and which I forecasted will hit $40 in short order, is silver - the precious metal hit another new high today of over $38/oz - further reinforcing my explanation that endless money injections in stock markets do more harm than good for the public. For example, have you seen the price of gas recently? Here's a dandy chart of today's most recent activity, updated at 2:10 PM.

It's interesting to note that despite the calls from experts that radioactive material will not even reach the shores, California health officials are closely monitoring the situation, as milk is one of the first food items to absorb radioactive elements. What will happen to the California milk industry if the milk is found to have high levels of radiation given the fact that California is the largest state producer of dairy? Say hello to $5/gal milk.

Another 6000 miles over in Portugal, it seems they have their own problems to deal with - a total collapse of the gov't and subsequent $100 Billion bailout. No worries though, as the ECB will be sure to simply buy up all sovereign bonds (now that debt downgrades are imminent) and pump Billions of Euros into the markets, a la Dr. Deficit.

Surely, major catastrophes are bullish for the global economy and stocks, right? After all, with so many investing oracles like Warren Buffet saying so, it must be so. Thus, even supply chain disruptions mentioned over the past two weeks here, help boost the global GDP, as Toyota, the worlds largest automaker today said they are "preparing to shut down all 13 plants in the US due to the disruptions." As one excellent website said, "why not just blow up unpopulated pieces of America and rebuild them over and over: it does miracles for the Chinese "GDP" - it should work just as well in the US - plus Krugman would be in a constant state of Keynesian extasy." We couldn't agree any more! Detroit seems like a good place to start, right Ben?

J, are you trading metals?

ReplyDelete@sirmodem- Not trading- investing for protection against devaluing fiat. Follow the money. In this case, the Chinese buying up all the gold and silver they can get their hands on IMO.

ReplyDelete