We have been saying for some time now (like, forever) that the unemployment situation in this country is spiraling out of control. Despite the outrageous and ludicrous "estimates" by Wall Street's finest (and over paid)

Today, we present to you the NFP (non-Farm Payrolls) report, which shows how horrific the employment situation in this country really is and there is no hiding the fact - even after a

Total NFP jobs was +18k on expectations of +105k (That's one of those laugh out loud moments). Private jobs was +57k on expectations of +132k (Another laugh out loud and roll on the floor moment). But wait! It gets better. Last month's data was revised down from +52k to +25k and the

But wait! There's more! The Labor Force Participation Rate drops to a fresh 25 year low and will soon break the all time low in 3... 2... 1... Courtesy of ZeroHedge. We couldn't explain it any better. And just in case you don't under stand what that means, we present another killer from ZeroHedge, this time a chart that shows the U.S. now needs to create 250k every month for 65 months in order to get back to pre-depression levels. The U.S. "economy" can't even generate 75k jobs per month with the Birth/Death model helping to massage the numbers. We ask again, how is this jobless recovery working out?

What a joke. Then again, the joke's on the Wall Street analysts who bought into the Fukushima radioactive bullish Kool-Aid. Time for them all to retire - and for Deutsche Bank to hire better help. Preferably DB can find someone without a

Speaking of winning, perhaps Mr. Buffett who is clearly senile and delusional, should pull a Heff - marry a young beautiful blonde and just retire already. Today, after the NFP, he announced that "jobs will come back once housing recovers." Well, Mr. Obvious, that's downright profound. But you forgot to mention, housing will never recover.

You figure it out. Maybe he didn't hear that each "stimulus job" that Obama created has cost $278k per? Nope. He didn't.

With the big NFP out of the way, we can almost be certain that QE3 is a given in one form or another. Of course, everyone with a

Of course, they'll never know that the ongoing and accelerating "War on Terror" has now officially cost more than WWII because Jersey Shore just took two hours of their lives. Think how many jobs the Three Amigos could have created with that $6.2 Trillion! Of course, with all of the up and coming job cuts, Dr. Deficit will simply ready the printers and everything will get better like it did the first time around.

Before we forget - as we predicted long ago, the handling of the Fukushima disaster will lead to social problems as the people uncover the truth and discover they have been lied to. Today, Reuters drops another

Being that today is FryDay, I thought it would be appropriate to leave you with a little something we have been working on for some time. So...

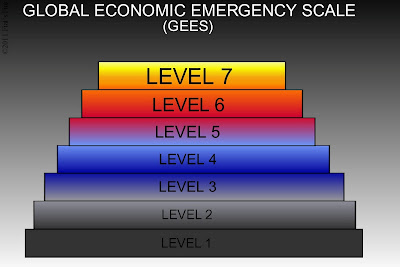

... you know how Goldman Sachs and the big boys have their expensive algorithms to front run orders and churn the markets for money? And thanks to Fukushima, you also know the INES scale that is used to determine nuclear emergencies? Well...

We have created the GEES scale, or the Global Economic Emergency Scale. The concept and design is similar and the interpretations are strictly our opinion. It is a 7 level triangle based on certain "events" to determine the level of emergency the global economy is in at any given time, in real time. We then created a simple algorithm based on certain metrics such as unemployment rates, oil prices, gold prices, food prices, overall inflation, global debt to GDP ratios, and even other less numerical statistical data such as bankster bonuses, climate catastrophes and other data from Transparency International. It's quite amazing how these metrics fell into place.

Level 7 is obviously the highest level of danger and implies imminent global financial meltdown whereas level 1 is the lowest danger level and represents only minor turbulence for the markets. More details of the levels are listed below the diagram.

The basics for now are worked out and the diagram you see below is a rough edition of what we are going to have completed soon. In the coming days, more data will be analyzed and extrapolated, and then we will play with the models to see what its predictive capabilities are. Also as the weeks go on, we will delve further into the details of the this scale and the geopolitical/socioeconomic metrics we look for. Without further ado, we present to you the Fiat's Fire GEES Global Economic Emergency Scale.

Level 2- This is the second lowest state of emergency. Minor risks and/or shocks to the financial system are now a certainty. Most events are still predictable but avoiding all problems associated with the events are more difficult. Unemployment increases sharply as businesses begin to "cut to the bone" in an effort to save profits early. Insiders of publicly traded companies increase the pace of selling of company stock. Central Banks still have leeway but generally by now have begun to make corrective changes to the system by cutting the discount rate. Interest rates may climb, despite slowing economic growth and negative outlooks. Gold and silver prices rise. Minor volatility in oil, gasoline prices. Residential real estate prices decline. The "risk on" trade slows as investors shift to neutral. Additional caution is necessary.

Level 3- This is a mid level emergency. Moderate risks and/or shocks are expected. Events are less predictable and less controllable. Central Banks hold special meetings to coordinate efforts and discuss risks. The rate to the discount window is cut sharply. Quantitative Easing is introduced. Interest rate volatility increases dramatically and prices become unstable despite slowing economic activity as Federal Reserve becomes buyer of last resort for gov't bonds. Gold and silver prices rise sharply, along with oil, gasoline and other commodities as investors anticipate looser economic policies. Investors begin to take profit in real estate and stocks and shift into cash and bonds. Residential and commercial real estate prices decline dramatically. Bigger shocks to the RE markets later become apparent. The investing environment shifts sharply to "risk off," but the possibility of future economic stimuli adds some investors to shift back to "risk on." Added volatility. Social unrest becomes noticeable in many areas.

Level 4- This is the highest mid level emergency and the last stop before the point of no return. It is very similar to a level 3 emergency in its structure, but on a larger scale. Moderate to major economic risks and/or shocks become the norm. Investors take profit on stocks and real estate. Insiders of publicly traded companies exercise options, sell their shares at record pace. Central banks enact emergency measures to lower interest rates, implement broad stimuli programs, cut discount rate to zero, provide unprecedented emergency lending to banks and institutions and try to avoid deflation at all cost. Gold and silver prices increase dramatically as demand picks up as a true safe haven. Oil prices increase on speculation that stimulus programs will have an inflationary impact on prices. Food, gasoline and other commodity prices increase. Stock fundamentals plummet as investor sentiment shifts into "risk off" and go into gold and silver and other tangible commodities. Quantitative Easing is implemented fully to artificially keep interest rates low and to keep stock prices artificially high. The unintended consequences of QE programs hit the commodities markets as prices skyrocket. Real estate prices however, continue to decline sharply and broadly. Unemployment continues to increase steadily as companies defend profits and bonuses. General strikes occur on a regular basis. Risk on/risk off trading environment. In general, everything still appears to the public as operating as normal despite sharp rises in unemployment and inflationary pressures. Official statistics reported by the Main Stream Media are massaged for consumer psychology and social purposes.

Level 5- This is the "point of no return" zone and the rate at which events accelerate rapidly. Most damage caused in this area tends to be permanent and irreversible. Moderate to major economic risks and shocks continue to erode investor and consumer sentiment. Unemployment rises steadily. Central Banks enact further emergency measures and begin to use other measures of which the consequences and side effects are unknown. Inflation increases sharply as the positive feedback loop now perpetuates the cycle - speculators bet on inflation from continued and increased use of Quantitative Easing and its many forms. Bond yields increase despite actions taken by Central Banks to contain rates and sharply declining global economy. Food and oil prices increase dramatically as the unintended consequences of Quantitative Easing really hit the markets hard. Social unrest increases and stirs violent protests. Gold and silver become the only investing safe havens.

Level 6- This is the final stage before imminent collapse. Governments continue to drown in debt and sovereign defaults begin. Central Banks enact all emergency measures available to them. Fiat money "printing" increases dramatically and Quantitative Easing returns in other forms and under another name. Social unrest and tensions are explosive. Violent mass protests erupt around the world. Bond yields of insolvent peripheral nations skyrocket. Central Banks attempt to contain the contagion. Financial risks are very high. Municipal defaults occur. Unemployment increases dramatically. Economic activity slows rapidly. All emergency measures are implemented to keep economy alive as hyperinflation spreads rapidly across the globe. Gold and silver skyrocket. Oil prices become nearly unattainable to most consumers. Tensions between ally nations rise, leading to political rifts.

Level 7- This is the highest emergency level. Total economic collapse is now imminent. As the great unwind begins, the pace of sovereign defaults accelerate leading to mass bank runs. Stock markets plummet and all trading is halted. After days/weeks of on/off halting, stock markets are closed indefinitely. Central Banks now enter COG mode and print limitless amounts of fiat. Violent protests lead to anarchy and social disorder. Looting becomes commonplace. Social systems breakdown as workers chose not to work. Martial law goes into effect. Gold and silver confiscated.

Please note that this scale is exponential by nature and not linear, meaning each level is greater than the next on the order of magnitude. There are no clear cut definitive lines per se, that separate the individual levels, as all emergency levels are confluent in form.

Levels 1-2 and 3-4 are closely related in many areas in the sense that many of the signals are interchangeable. The transitions between them are barely perceivable to many. However, levels 5 though 7 are unique in sense that the transitions between them become immediately more harsh and distinguishable. However, the most important factor that distinguishes levels 5-7 from the previous is the time frames during which they appear and occur. Where levels 1-4 may have occurred over a period of many months or perhaps years each, levels 5-7 appear and develop rapidly. For example, using these same metrics, the global economy entered in a level 1 emergency in early 2005 and this lasted throughout all of 2006 - almost a span of two years. In early 2007, the global economy entered a level 2 emergency and this changed into a level 3 by mid 2008. By late 2008, we entered a level 4 emergency and have been since - until now. We have now entered level 5, the point of no return.

During levels 1-4, the economy, although very unstable still had room to grow and recover. However, greed again ruled and disrupted the natural healing process of a free market. Because TPTB could not allow the free market to self-correct, they intervened and by doing so created a moral hazard similar to what Europe faces as it bails out member nations (besides the bailouts being illegal under EU rules, it became a major moral hazard). Because of their vested interest in the declining markets, they could not allow the markets to correct. Once they did that, there would be no end to their manipulation of the markets to keep it going - until they lose all control. It's a mathematical certainty that Level 6 will be here soon enough.

Over the weekend we invite you to read though the information and please post your comments and opinions here. We enjoy all of your emails, but we're sure others would also like to read your thoughts and opinions - and you can do it anonymously if you choose. Have a safe and happy weekend.

Cool stuff you are working on! what are you doing it with...matlab?

ReplyDeleteI am pretty sure we already know what a working model would line out.... :)

the #1 thing this country should do is END the FED. paying compound interest to infinity to a private cabal of bankers is insane. Debt money is insane. The federal reserve system is INSANE!!

ReplyDeletehttp://www.youtube.com/watch?v=bscqVRUsd50&feature=watch_response

this is some system you set up here with this pyramid and all.... my only concern is that we may already be in level 6 according to the info!!!! if im reading that right....maybe... but this blog packs a punch i gotta say... I REALLY mean that because its not just token news but your commentary is VERY informative and witty which is what I need to get through the day..... and you bring all of the pieces of the puzzle together!!!! NICE work!! 10* all the way....

ReplyDeleteCiao Italia: http://www.zerohedge.com/article/europe-scrambles-deal-italy-contagion-fallout-calls-emergency-meeting-former-ecb-official-sa

ReplyDeleteIt also seems Italy is looking into banning naked shorts as early as tonite to prevent a complete market rout. Not sure how serious this is as yet, but if Italy crumbles, so does the EU and the Euro. I'm kinda astounded at just how fast this is happening.

Hallo my friend! Thanks very much for this info. I do have a question about the GGES because I want to know what we should do when he have level 6? Thanks. From MPP5 in Sweden.

ReplyDeleteit sounds to me like we are in level 6 already.....

ReplyDelete@Anon1- Using a ruler and a pencil. Thank you.

ReplyDelete@Anon2- I concur. But that won't happen until the collapse.

@Cyrus- Could be. Once in level 5 things move fast. I appreciate the kind words.

@Mr. K- Thank you as always. I got the alert early and it made my hair stand up.

@MPP5- Thank you. Continue as you should be doing now. Stocking up on tangibles.

@Anon- Yes, it does but not quite yet. They will put this fire out for a short time until Spain lights up. Then it's on like DK.

Good reading tthis post

ReplyDelete