Update 2: An excellent informative video describing what is really going on in Japan. Must see.

Update 1: Weird, meet bizarre. It seems the Kamikaze lifestyle is alive and well in Japan. Kyodo News is reporting that an unknown vehicle and two passengers tried to run into the Fukushima Daiichi plant a short while ago. The purpose is unknown, but we can only assume, they'd rather go out in a bang, than a slow glow.

First, let's play a little game we like to call, "Guess That Glow!" Observe the animation below, and see if you can guess what those glowing dots are. The first person to answer the question correctly, wins a trip inside the Fukushima #1 reactor health spa. Remember, it's healthy radiation.

As Energy News is reporting, a partial meltdown in reactor 1 may cause some isolated reactions. One can only guess what that means for the environment. Rest assured, this will be bullish for the stock market, as the DOW will probably rise a few hundred points on news of a total meltdown.

Today, the makers of Tylenol, Johnson & Johnson announced it will reorganize (read: cut more jobs) after a line of 20 recent recalls on it's most popular brands. Don't expect to see any pay/bonus cuts for the top execs however; the workers that actually do the leg work will be the ones that will probably be cut first.

Don't look now, but the US Treasury is going broke in 3... 2... 1... After this week's 3 big auctions totaling $100 Billion are settled, the Treasury will have exceeded the $14.294 Trillion debt limit, which at this point seems more like a suggestion that an actual set limit. We should see another big rally in the markets if this is true. We suggest everyone interested in this topic, does a case study on Zimbabwe circa 2007-2009. Their "stock market" saw the largest "gains" during that period.

Not to be missed is this week's Initial Claims data, showing - surprise, surprise - another revision. Not only was last week's employment data a joke, but now it's confirmed it was a lie. Add another 12k people to the rolls. And the "decrease of 6k" this week? Just look at the initial data and compare it to the revised data. That's how you cook when your name is not Rachel Ray.

Japanese officials must think their citizens are radioactive-proof since, despite the fact that high levels of radiation have been found inside the "safe zone," they refuse to expand the evacuation area.

Two final notes: The EU probably has only a few weeks, if not a few days remaining as a single monetary union. Today, Portugal revised its deficit upward by more than a whole point. Not only can we expect to see more downgrades in Portugal, Ireland and Greece but also now in Spain. With word about Ireland saying they'll stop making payments, it's only a matter of time before the bond yields on all peripheral nations explode to 25% on the 10yr, bringing the entire EU to its knees. Worse still, European inflation "unexpectedly" rose by the fastest pace in almost 3 years and is now currently at 2.6%. Of course, to savvy investors that read this blog, this should come as no surprise. After all, in an oil dependent global economy which sees oil prices explode nearly 100% in just over 1.5 years, what else can we expect. With WTI trading at $105+ and on the heavy side, don't expect to see gasoline go below $3.50 for a long time. Did we mention, this is bullish for the economy?

More updates soon.

Thursday, March 31, 2011

Wednesday, March 30, 2011

Radioactive Iodine-131 In PA, MA 3000% Above Federal Limit. Guess What? It's Still "Safe"; "Suicide Squads" Paid Huge Amounts Of Yen To "Volunteer"; Japanese Business Confidence Collapses

Now that you already know radioactive iodine has been discovered all around the world, from California to Scotland to France, tests are being conducted here in the US on drinking water and public water sources. Thus far, the results are not looking good. In two separate tests on public water, radioactive iodine-131 in Pennsylvania has been found to be 3300% above the federal standard. Yet, officials claim it is still, "safe." Makes us go hmmmmm.

What is wealth without health? Obviously its everything to the dozens of "volunteers" working at the stricken Fukushima plant. It is now being reported that workers are being paid up to $1000 per day to work at the plant and risk their lives. Of course, now that the official limit of what is "safe" has been raised, they have nothing to fear... Ask them in 3 months if it was worth the money.

With heavily invested experts saying nearly every current event taking place around the world over the last 2 years including major earthquakes, tsunamis, massive loss of human life, and wars are bullish for the economy, one has to wonder if they went to the same school of economics as Japanese CEOs. A whopping 68% of companies surveyed say a recession due to the catastrophe is imminent, versus only 10% a short time before the catastrophe. Is this code speak for "pump more money"?

Finally, now that nuclear has seen it's day, scientists at MIT have produced a leaf that can power an entire home. That's correct: a leaf that produces electricity, enough in fact to power an entire home and is the same size and shape as a playing card. Line up a few cards in a box the size of a window A/C unit and it might be able to power an entire factory. Perhaps. The process used to make the electric is even simpler than any other device before it. It simply splits water into hydrogen and oxygen which are then "stored in a fuel cell and used later to generate electricity." A great read and perhaps an answer to the energy future.

More updates later.

What is wealth without health? Obviously its everything to the dozens of "volunteers" working at the stricken Fukushima plant. It is now being reported that workers are being paid up to $1000 per day to work at the plant and risk their lives. Of course, now that the official limit of what is "safe" has been raised, they have nothing to fear... Ask them in 3 months if it was worth the money.

With heavily invested experts saying nearly every current event taking place around the world over the last 2 years including major earthquakes, tsunamis, massive loss of human life, and wars are bullish for the economy, one has to wonder if they went to the same school of economics as Japanese CEOs. A whopping 68% of companies surveyed say a recession due to the catastrophe is imminent, versus only 10% a short time before the catastrophe. Is this code speak for "pump more money"?

Finally, now that nuclear has seen it's day, scientists at MIT have produced a leaf that can power an entire home. That's correct: a leaf that produces electricity, enough in fact to power an entire home and is the same size and shape as a playing card. Line up a few cards in a box the size of a window A/C unit and it might be able to power an entire factory. Perhaps. The process used to make the electric is even simpler than any other device before it. It simply splits water into hydrogen and oxygen which are then "stored in a fuel cell and used later to generate electricity." A great read and perhaps an answer to the energy future.

More updates later.

Tuesday, March 29, 2011

From The Strange, To The Absurdly Bizarre; All Eyes On Japan, Forgot About Burma; Good News About Plutonium - It's "Healthy!"; Tokyo Electric Exec Goes AWAL; China Rejects Japanese Ship Due to Radiation

Update 2: What's a little radiation going to do? Fly around the earth in plumes now reaching as far as Scotland and France. Needless to say, officials claim the levels are "extremely low," so go ahead, roll around in the grass and pick up some "healthy" radiation. Duh! #glowing, is the new Duh! #winning.

Update 1: Not that the markets care about fundamentals, but you may want to know the S&P has just downgraded two more PIIGS, Portugal and Greece, and stated there is a very high probability that they will not be able to meet requirements (read: default).

In another round of news that shows just how bizarre this world has become, Lawrence Solomon, writer for the Financial Post, tried (and failed) to make a case that somehow radioactive Plutonium is not only safe, but actually healthy for you! It's a must read if you need a good laugh to start your day off right; one can only wonder how much it costs to buy an "expert" these days to say just about anything. What's next? Taking baths in TEPCO reactor runoff water will decrease wrinkles and add health to your life... Don't laugh. You may see that soon enough.

Now that you know that plutonium is healthy for you, someone needs to ask the Chinese why they rejected a ship that originated in California and docked in Tokyo for a few hours. Surprise, surprise. The answer is - They rejected it because of high levels of radiation.Hu Who would have thought the Chinese were so particular about healthy plutonium poisoning?

Of course, with plutonium now being discovered in soil samples around the plant and Dr. Michio Kaku confirming that there was a "breach," there's little wonder then why the president of TEPCO has gone AWAL. There are rumors he fled the country or committed suicide. TEPCO officials claim he is "sick" from all the work - of being a Japanese CEO. One could argue, the tsunami got him either way.

Since the only news that matters now are global current events, I present to you one last "bullish" news item from the little country of Burma as all the focus from the media remains on Japan. Not only did Burma experience a powerful 6.8 magnitude earthquake a few days ago, the week before they experienced a major tropical storm of epic proportions in which 3700 Burmese fishermen are still missing. Definitely should be worth an extra 200 points on the DOW today.

Check back often for more updates.

Update 1: Not that the markets care about fundamentals, but you may want to know the S&P has just downgraded two more PIIGS, Portugal and Greece, and stated there is a very high probability that they will not be able to meet requirements (read: default).

In another round of news that shows just how bizarre this world has become, Lawrence Solomon, writer for the Financial Post, tried (and failed) to make a case that somehow radioactive Plutonium is not only safe, but actually healthy for you! It's a must read if you need a good laugh to start your day off right; one can only wonder how much it costs to buy an "expert" these days to say just about anything. What's next? Taking baths in TEPCO reactor runoff water will decrease wrinkles and add health to your life... Don't laugh. You may see that soon enough.

Now that you know that plutonium is healthy for you, someone needs to ask the Chinese why they rejected a ship that originated in California and docked in Tokyo for a few hours. Surprise, surprise. The answer is - They rejected it because of high levels of radiation.

Of course, with plutonium now being discovered in soil samples around the plant and Dr. Michio Kaku confirming that there was a "breach," there's little wonder then why the president of TEPCO has gone AWAL. There are rumors he fled the country or committed suicide. TEPCO officials claim he is "sick" from all the work - of being a Japanese CEO. One could argue, the tsunami got him either way.

Since the only news that matters now are global current events, I present to you one last "bullish" news item from the little country of Burma as all the focus from the media remains on Japan. Not only did Burma experience a powerful 6.8 magnitude earthquake a few days ago, the week before they experienced a major tropical storm of epic proportions in which 3700 Burmese fishermen are still missing. Definitely should be worth an extra 200 points on the DOW today.

Check back often for more updates.

Monday, March 28, 2011

Glowing Soil, Glowing Water; World's Most Complex Supply Chain Broken; World's Ecological System Disrupted; First New Gulf Oil Drilling Permit Approved

As mentioned here numerous times already, with so many supply chain disruptions now occurring around the world due to plant shutdowns in Japan, there is little comfort in knowing that an already fragile broken global economy needs more heavy burdens. Despite this, investors are bombarded on a daily basis with happy talk from the main stream media about all sorts of positive outcomes from the March 11th global catastrophe. The word global is fitting to describe this catastrophe because the consequences are truly global - from supply chain disruptions that have put dozens of automobile plants around the world on hiatus, to electronic manufactures now in emergency mode seeking new supplies of microchips and other sensitive parts, to the yet unknown impact of contaminated drinking water and food around the world. Worse, in order to keep the rods cool, workers are pumping thousands of gallons of sea water on the chambers to keep the temps down. Two questions arise: One, how long can they keep this going, and two where will all this runoff go as the NY Times is reporting?

Some new video footage below out of Fukushima today showing the condition of the reactors - it doesn't look good and the commentary is not very encouraging.

In Japan, the worst type of radiation has been discovered - that of plutonium, in high concentrations, in the soil no less. Of course, raising the legal limit to what is safe might do the trick to get people back in their homes. Some 6000 miles away, radioactive iodine 131 has been discovered in the rainwater, in places across the US, such as Massachusetts, Pennsylvania, Florida and New Jersey. The quote of the day however, goes to one Boston official who said about the radioactive iodine, "levels in water are below detection." No further comment is necessary.

The long term impacts of this incident have yet to be seen and currently, the prospects don't look good for the world as one expert said. In some places around the world, nations such as Germany are already starting to plan for a nuclear free future.One thing is certain however, the earth's delicate ecological balance has been disturbed as today's most recent example shows hundreds of star fish wash up dead on the shores of England. Could the BP Gulf oil spill be related? Seems plausible. Speaking of the Gulf, it is interesting to note that the US has approved the first new permit for Gulf drilling since the spill last April. Just in time for the 1 year anniversary. Of course, all of this destruction is somehow "bullish" for the economy, although, the only primer of this bullishness is free money via direct money injections into the stock markets - put your rally hats on!

Check back often. More updates soon.

Some new video footage below out of Fukushima today showing the condition of the reactors - it doesn't look good and the commentary is not very encouraging.

In Japan, the worst type of radiation has been discovered - that of plutonium, in high concentrations, in the soil no less. Of course, raising the legal limit to what is safe might do the trick to get people back in their homes. Some 6000 miles away, radioactive iodine 131 has been discovered in the rainwater, in places across the US, such as Massachusetts, Pennsylvania, Florida and New Jersey. The quote of the day however, goes to one Boston official who said about the radioactive iodine, "levels in water are below detection." No further comment is necessary.

The long term impacts of this incident have yet to be seen and currently, the prospects don't look good for the world as one expert said. In some places around the world, nations such as Germany are already starting to plan for a nuclear free future.One thing is certain however, the earth's delicate ecological balance has been disturbed as today's most recent example shows hundreds of star fish wash up dead on the shores of England. Could the BP Gulf oil spill be related? Seems plausible. Speaking of the Gulf, it is interesting to note that the US has approved the first new permit for Gulf drilling since the spill last April. Just in time for the 1 year anniversary. Of course, all of this destruction is somehow "bullish" for the economy, although, the only primer of this bullishness is free money via direct money injections into the stock markets - put your rally hats on!

Check back often. More updates soon.

Friday, March 25, 2011

Fukushima Faces Facts on Nuclear Breach; Evacuations "Encouraged"; Mass Job Fair Canceled Due To Lack of... Jobs; Markets Ignore Fundamentals; Annualized M1 Hits 11.3%, GDP "Grows" 3.1%; Sales of Doomsday Bunkers Up 1000%

Update 6: Here's an update that deserves not only a separate post, it perhaps deserves an entire blog dedicated to the absolute madness and propaganda we are exposed to on a daily basis. This example illustrates the hopelessly pathetic job situation in this country. In brief, an entire "job fair" in Massachusetts was canceled due to - wait for it... wait for it... "a lack of jobs!" You can't make this stuff up.

Update 5: In just another example of how serious this situation is and can not simply be explained by "poo and fart" cartoons, 2 Japanese travelers from Tokyo flying to China were treated for "severe" radiation levels. Expect to see more as the situation spirals out of control. These are the first cases of passengers coming from Japan with such high levels. Last week, detectors were set off in Dallas and Chicago when passengers from Tokyo arrived at a checkpoint, but the levels were still low. Not this time.

Update 4: How does the gov't of Syria disperse protesters in the streets? Shoot 'em up. As expected, the Egyptian uprising was just the start of things to come. Next up, expect to see US boots in Syria.

Update 3: Some great video showing the extent of the damage now coming out of China, Myanmar, and Thailand of today's 6.8 earthquake. As you can see, all that destruction and loss of human life is positive news for the markets. Rally on.

Update 2: Kyodo news is reporting that now 3 reactors are confirmed breached. Then again, by simply looking at the pictures, one could have concluded 10 days ago that they were breached. More soon.

Update 1: A survey by NHK is showing that 60% of the survivors of the March 11th catastrophe are unlikely to return home and probably never will.

Before we discuss "the markets" or whatever you want to call them now, let's briefly look at the situation in Japan, which has "officially" deteriorated. The breaking news over night that a "breach" in a reactor "may have occurred" and that the situation is now "very grave and serious" should be no surprise to keen investors watching world news events. For even laymen know that when radiation is detected thousands of miles away in Iceland, when radiation in drinking water 150 miles away is detected, when high levels of radiation in sea water miles away are discovered, when radiation levels 25 miles away from the epicenter in the air are so high one could get sick in hours if not minutes, when radiation is detected in milk and food and made unsafe -- we know at least one of those 6 reactors is leaking. Which is why it is particularly interesting the officials are just now saying "evacuations are encouraged" between the 12-19 mile "safe to stay indoors" zone when the US and all other nations had set the minimum limit at 50 miles. I wonder if money has anything to do with that?

Now that it's been admitted officially that the rods are exposed and likely have been since the March 14th explosions, we can now accept that this is beyond the Chernobyl accident. Of course, this has been known since almost 10 days ago that "Uncovered Nuclear Fuel Rods In Japan Could Ignite A Chernobyl-Like Disaster" as the title of this article dated the 16th of March states. Also 10 days ago, Japanese officials talked about a "lag time" of information as to the reason why the entire world was saying the disaster was much worse than they were admitting to. It seems the "lag time" they were talking about applied to them. Who's kidding who?

Of course, they can always raise the "healthy" limit of radiation exposure... oh, scratch that - they already did. This leads nicely into two other topics: 1) Is this event a foretaste of the way other gov'ts handle these types of situations, which have a very high probability of occurring and 2) if the markets even care anymore about any bad news, here, here, here, here, here and here just to start. Notice too, the timing of an "upward revised" GDP could not have come at a better time (I say show me the money!).

All that matters is the endless flow of money being pumped into the markets to keep them up. Do you have your rally hats on? A quick look at the markets shows green everywhere with a 100 point rally today. Remember the mantra - bad news is good news for the stock markets in this upside down world. At least the wealthy will be saved, as they dole out $20 million for their underground bunkers which have seen sales rise 1000% since January.

As reported here yesterday, Portugal needs $100 Billion in funding and fast. Not only did the entire gov't disintegrate, Portugal has run out of money; not to mention the ECB is looking at even more funding for Greece as well. Soon, Spain will follow. Then comes Ireland looking to get more or simply leave the EU entirely. If a major earthquake struck at the heart of Europe, perhaps the markets would have yet another reason to rally. Absurd, or is it? Take a look at the M1 money supply being pumped into the economy.

Thus, we will continue to see more inflation around the world in the things we need and use everyday, and deflation in things we want to keep as an investment such as housing. But who wants to hear about fundamentals? All that matters is the Fed's unofficial mandate to pump up the markets at any "cost" until the DOW reaches 54,000. Therefore, I leave you with the most important topic that means anything right now and for many months ahead - Japan.

Thursday, March 24, 2011

What's On Tap?; Silver Tops $38; California Milk, Canary In Coal Mine; Portugal Flops, Fitch Pops; Salty Reactor Rods; Pressure Rises in Reactor 1, 5&6 Leaking

The next time you turn on your faucet and drink a glass of water, you might want to think about the people in Japan. Japan Times is reporting that radioactive water has been detected far from Fukushima in the Chiba and Saitama Prefectures as well as the city of Tokyo. This has led to a panic run on bottled water and this has many worried of the long term consequences and availability of clean drinking water.

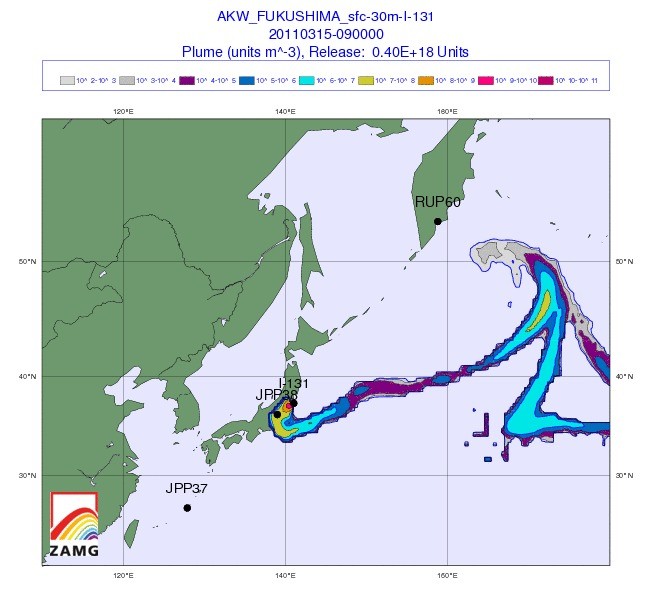

It doesn't look like anyone will be going swimming off the Eastern coast of Japan anytime soon. Radioactive iodine 147 times the legal limit has been discovered. Now, you can get a tan both in the water and out. The following image may help to explain why:

Not to be missed today are the rising temperatures in reactor 1 which have passed their max operating temperature by 200+ degrees, but also the salt coated rods exposed to the endless amount of sea water used to cool them. Somehow, we think they can't keep this going much longer.

Quickly jumping to a precious metal that I wrote two weeks ago you should keep your eye on and which I forecasted will hit $40 in short order, is silver - the precious metal hit another new high today of over $38/oz - further reinforcing my explanation that endless money injections in stock markets do more harm than good for the public. For example, have you seen the price of gas recently? Here's a dandy chart of today's most recent activity, updated at 2:10 PM.

It's interesting to note that despite the calls from experts that radioactive material will not even reach the shores, California health officials are closely monitoring the situation, as milk is one of the first food items to absorb radioactive elements. What will happen to the California milk industry if the milk is found to have high levels of radiation given the fact that California is the largest state producer of dairy? Say hello to $5/gal milk.

Another 6000 miles over in Portugal, it seems they have their own problems to deal with - a total collapse of the gov't and subsequent $100 Billion bailout. No worries though, as the ECB will be sure to simply buy up all sovereign bonds (now that debt downgrades are imminent) and pump Billions of Euros into the markets, a la Dr. Deficit.

Surely, major catastrophes are bullish for the global economy and stocks, right? After all, with so many investing oracles like Warren Buffet saying so, it must be so. Thus, even supply chain disruptions mentioned over the past two weeks here, help boost the global GDP, as Toyota, the worlds largest automaker today said they are "preparing to shut down all 13 plants in the US due to the disruptions." As one excellent website said, "why not just blow up unpopulated pieces of America and rebuild them over and over: it does miracles for the Chinese "GDP" - it should work just as well in the US - plus Krugman would be in a constant state of Keynesian extasy." We couldn't agree any more! Detroit seems like a good place to start, right Ben?

It doesn't look like anyone will be going swimming off the Eastern coast of Japan anytime soon. Radioactive iodine 147 times the legal limit has been discovered. Now, you can get a tan both in the water and out. The following image may help to explain why:

Not to be missed today are the rising temperatures in reactor 1 which have passed their max operating temperature by 200+ degrees, but also the salt coated rods exposed to the endless amount of sea water used to cool them. Somehow, we think they can't keep this going much longer.

Quickly jumping to a precious metal that I wrote two weeks ago you should keep your eye on and which I forecasted will hit $40 in short order, is silver - the precious metal hit another new high today of over $38/oz - further reinforcing my explanation that endless money injections in stock markets do more harm than good for the public. For example, have you seen the price of gas recently? Here's a dandy chart of today's most recent activity, updated at 2:10 PM.

It's interesting to note that despite the calls from experts that radioactive material will not even reach the shores, California health officials are closely monitoring the situation, as milk is one of the first food items to absorb radioactive elements. What will happen to the California milk industry if the milk is found to have high levels of radiation given the fact that California is the largest state producer of dairy? Say hello to $5/gal milk.

Another 6000 miles over in Portugal, it seems they have their own problems to deal with - a total collapse of the gov't and subsequent $100 Billion bailout. No worries though, as the ECB will be sure to simply buy up all sovereign bonds (now that debt downgrades are imminent) and pump Billions of Euros into the markets, a la Dr. Deficit.

Surely, major catastrophes are bullish for the global economy and stocks, right? After all, with so many investing oracles like Warren Buffet saying so, it must be so. Thus, even supply chain disruptions mentioned over the past two weeks here, help boost the global GDP, as Toyota, the worlds largest automaker today said they are "preparing to shut down all 13 plants in the US due to the disruptions." As one excellent website said, "why not just blow up unpopulated pieces of America and rebuild them over and over: it does miracles for the Chinese "GDP" - it should work just as well in the US - plus Krugman would be in a constant state of Keynesian extasy." We couldn't agree any more! Detroit seems like a good place to start, right Ben?

Wednesday, March 23, 2011

Healthy Smoke, Healthy Water; Egyptian Stocks Mummified; Food Imports Banned

Update 3: A New Radiation Forecast video from our Norwegian friends at the Norwegian Institute for Air Research (NILU) shows that indeed, the radioactive plumes do not dissipate in the air and will soon cover the entire earth. However, since we are all now informed by certain experts that 'radiation is healthy,' this plume should help boost population numbers in countries with zero population growth and give a boost to the global economy. Next up - Monsanto awarded a $900 Billion gov't contract to produce Radioactive Resistant Corn (Plutonium FrankenKorn). The positive results can been seen here.

Update 2:Hu Who said "no boots in Libya?" Tensions in the Middle East are escalating rapidly. The US will now deploy 2200 Marines to Libya. Yes, the plot thickens. Now with Israel on the brink of an all out Arab/West/Middle East/China/Russia War (let's call it what it is, WWIII), it might be time to fill up your car before gas goes to $5.00/gal. Certainly, rising fuel costs are due to increased demand due to the recovery we see around the globe. Isn't that right, Warren?

Update 1: Simply amazing news breaking from Japan - "Tokyo Electric Power Co. said Wednesday it has observed a neutron beam, a kind of radioactive ray, 13 times on the premises of the Fukushima Daiichi nuclear plant after it was crippled by the massive March 11 quake-tsunami disaster." This means that the worst case scenario has occurred- Nuclear fission of Pu (Plutonium) and possibly U (Uranium), has occurred and is being released into the environment at a tremendous rate. Now, not only do the citizens of Japan have to worry about Cesium or Iodine, they have to worry about Plutonium and Uranium. This would also explain the high temps coming from the reactors as fission is taking place. Of course, the officials claim it's safe.

Another day, another round of unbelievable news, with the Award For The Most Bizarre (AFTMB) being a toss up between nuclear engineers blowing their tops on flaws in the Fukushima reactor's designs and a cartoon for children in Japan about the nuclear accident. You decide. Vote in the comment section.

First -- another round of whistleblowers coming forward to declare that the stricken Fukushima plant Mark 1 design by GE was "so flawed" it could lead to a major accident and they resigned out of protest. According to ABC News, "questions persisted for decades about the ability of the Mark 1 to handle the immense pressures that would result if the reactor lost cooling power, and today that design is being put to the ultimate test in Japan. Five of the six reactors at the Fukushima Daiichi plant, which has been wracked since Friday's earthquake with explosions and radiation leaks, are Mark 1s."

Of course, it doesn't stop there. GE designed 23 of these same reactors for use in the US - essentially exact copies of the ones in Fukushima. Needless to say, those same design flaws were carried over as the New York Times reports. What would happen if a major earthquake struck in any of those areas shown in the map below?

Second -- A nuclear emergency is not a time to be making baby talk, but the Japanese, in their best efforts to pacify their children into thinking everything is ok, have made a cartoon using "poo and farts" to explain the seriousness of this situation. Unfortunately, we think it failed. Which one is more bizarre?

In a new series of "a little radiation is safe for you" comes new reports showing extremely high levels of radiation in drinking water in Tokyo. It's a mystery to the best Japanese officials how that radiation got there! Perhaps it came from the healthy black smoke now seen rising out of a 700 degree reactor. While you're at it, consider that the level of radiation over a half mile from reactor 3 was 265.1-microsieverts-per-hour, enough to make you sick in minutes. We can assume the evacuation of the plant means something is brewing.

Now that spinach, milk and other items from Japan are radioactive, countries from Hong Kong to the US are halting imports of Japanese food products. Of course, Warren Buffet sees this as positive for the economy along with the complete shut down of dozens of factories and plants across Japan. Supply chains? Who needs that? Speaking of positive, this disaster is now the costliest incident ever by a long shot to hit the world. Put your rally hats on!

Not to be missed this week are the collapse of the Portuguese gov't over austerity measures and the Egyptian stock market crashing 10% on it's first day back in service after a long two month shut down. Guess the turkey was not ready yet.

More updates soon.

Update 2:

Update 1: Simply amazing news breaking from Japan - "Tokyo Electric Power Co. said Wednesday it has observed a neutron beam, a kind of radioactive ray, 13 times on the premises of the Fukushima Daiichi nuclear plant after it was crippled by the massive March 11 quake-tsunami disaster." This means that the worst case scenario has occurred- Nuclear fission of Pu (Plutonium) and possibly U (Uranium), has occurred and is being released into the environment at a tremendous rate. Now, not only do the citizens of Japan have to worry about Cesium or Iodine, they have to worry about Plutonium and Uranium. This would also explain the high temps coming from the reactors as fission is taking place. Of course, the officials claim it's safe.

Another day, another round of unbelievable news, with the Award For The Most Bizarre (AFTMB) being a toss up between nuclear engineers blowing their tops on flaws in the Fukushima reactor's designs and a cartoon for children in Japan about the nuclear accident. You decide. Vote in the comment section.

First -- another round of whistleblowers coming forward to declare that the stricken Fukushima plant Mark 1 design by GE was "so flawed" it could lead to a major accident and they resigned out of protest. According to ABC News, "questions persisted for decades about the ability of the Mark 1 to handle the immense pressures that would result if the reactor lost cooling power, and today that design is being put to the ultimate test in Japan. Five of the six reactors at the Fukushima Daiichi plant, which has been wracked since Friday's earthquake with explosions and radiation leaks, are Mark 1s."

Of course, it doesn't stop there. GE designed 23 of these same reactors for use in the US - essentially exact copies of the ones in Fukushima. Needless to say, those same design flaws were carried over as the New York Times reports. What would happen if a major earthquake struck in any of those areas shown in the map below?

Second -- A nuclear emergency is not a time to be making baby talk, but the Japanese, in their best efforts to pacify their children into thinking everything is ok, have made a cartoon using "poo and farts" to explain the seriousness of this situation. Unfortunately, we think it failed. Which one is more bizarre?

In a new series of "a little radiation is safe for you" comes new reports showing extremely high levels of radiation in drinking water in Tokyo. It's a mystery to the best Japanese officials how that radiation got there! Perhaps it came from the healthy black smoke now seen rising out of a 700 degree reactor. While you're at it, consider that the level of radiation over a half mile from reactor 3 was 265.1-microsieverts-per-hour, enough to make you sick in minutes. We can assume the evacuation of the plant means something is brewing.

Now that spinach, milk and other items from Japan are radioactive, countries from Hong Kong to the US are halting imports of Japanese food products. Of course, Warren Buffet sees this as positive for the economy along with the complete shut down of dozens of factories and plants across Japan. Supply chains? Who needs that? Speaking of positive, this disaster is now the costliest incident ever by a long shot to hit the world. Put your rally hats on!

Not to be missed this week are the collapse of the Portuguese gov't over austerity measures and the Egyptian stock market crashing 10% on it's first day back in service after a long two month shut down. Guess the turkey was not ready yet.

More updates soon.

Tuesday, March 22, 2011

As Water Boils Away, Dollar Gets Cooked; UK Inflation Explodes; Glowing Gold; Still Bullish on Japan Crisis?; Three 6.5 Magnitude Quakes in Less Than 2 Hours in Japan

Yesterday I posted a new radiation map of Japan showing elevated radiation levels even 20+ miles from the epicenter. Now today, the Japanese news agency affiliate of CNN, NHK, is reporting on this, as testing of the soil has shown radioactive iodine-131 and radioactive cesium-137 present one half of an inch in the soil, 25 miles from the Fukushima plant. Of course, this is being reported as posing "no health risk."

See for yourself.

No doubt, many questions arise as to the how's and why's of this radiation supply source now a full week after the big explosions at the plant. Perhaps a steady release of radiation is emitted through the grayish white

In addition to the obvious radiation "discoveries," CNN is reporting three strong earthquakes of 6.6, 6.4 and 6.4 magnitude all within less than two hours off the coast of Honshu Japan. Is the earth telling us something? Some experts seem to think so and this time, additional injections of money won't be able to make up for the economic losses. Without a major disaster, the dollar is already dead. What will more injections do? The answer is simple - cause further inflationary pressures as can be seen in the UK which has now hit another high of 4.4%. I think we could see the brakes come on very soon in the UK and the EU as inflation becomes uncontrollable. See the post dated the week of the 7th of March for more info on the catch 22 of this situation.

Of course, with the dollar's safe haven status being eroded by madmen at the printing machines, headed by Dr. Deficit, what are investors to do but invest in real inflation protection assets such as gold and silver. Thus, gold only a few dollars away from the high today. This chart looks good for gold bulls. This chart looks better for gold bulls.

As noted here all last week, the crisis in Japan is not a reason to be bullish on the global economy. Despite so many well respected investors saying to buy the sushi dip, it only took a few days to already see the problem begin to emerge from this one single crisis. Remember what I said about the multiplier effect and the supply chain disruptions? This is just the tip of the iceberg.

Therefore, it doesn't take a celebrity financial analysts to know disasters are not good for such an interdependent and interconnected global economy. That may have worked 50 years ago, but not so today. As posted here, inflation is the primary driver to stock prices since organic growth is dormant. Nevertheless, with the endless "printing" of money around the globe, stocks are pressured to rise - disasters pressure them down. Net impact in price is minimal.

It also doesn't take a geologist to tell you that more earthquakes are on the way and that if one big one hits California, or somewhere in Europe for example, the consequences will be far reaching and perhaps unrecoverable.

Finally, I present you with this radiation forecast from our Norwegian friends, which shows radioactive Xenon plumes circling the globe in a few days time. But have no fear - the limits to what are considered "healthy" have just been raised. Additionally, since Xenon can be used as a general anesthetic, you should begin to feel pain free very shortly.

Monday, March 21, 2011

Radioactive Japan, All Over Again; Stocks Love Wars; Portugal Puts The "P" In PIIGS; "Healthy Doses" of Radiation To Be Marketed By Big Business

Update 2: Another great real time radiation map has emerged. Must see for reference.

Update 1: Some first person raw footage from just a few feet from reactor #3. Great video.

What a difference a week plus a weekend makes when it comes to headline news. Just ten days ago, nearly every TV channel, newspaper and media outlet was covering every grain of radioactive sand found on the beaches from Okinawa to Kinki - today it seems as if there is some sort of media blackout. Indeed, a quick glance at today's headlines from one popular search engine's main page produces March Madness coverage, a death in sports, Tiger Woods' new fling and two popular actresses wearing (gasp!), the same dress! Buried a page or two over under a pile of Charlie Sheen videos, you'll find that radiation levels in food in Japan is much higher than first thought. Ok, so not a total blackout of coverage per se, but it does show how quickly news, no matter how significant, becomes stale. Therefore, out of respect, no mention of the radiation emergency will be mentioned in this post... until at least the 6th paragraph or Charlie Sheen is noted 3 times, whichever comes first.

Warren Buffet today told a group of people in South Korea that the situation in Japan is a "buying opportunity" and this crisis "will not change its economic future." Reading this statement like a Philadelphia lawyer, one could interpret this as "Japan has been in an economic slump for the past 20 years and this won't change that." However, considering his otherwise bullish sentiment about this crisis presenting a buying opportunity, it's very unlikely he meant for you to read between the lines like Charlie Sheen does.

We'll see in the coming months how this all plays out, but I'm going to stick with this a being what it really was/is - a black swan event. Over the next few months, keep in mind the term "multiplier effect." Remember, like a double edged sword, it cuts both ways and as reported here last week, the supply chain disruptions will be difficult to overcome no matter how much money is thrown at this event. Following their logic that this event is bullish, then perhaps they should all hope for more tsunamis. Remember, since that faithful day in 2008, bad news is now good news for the markets. Especially war. War has typically produced gains in the markets. In fact, the markets love wars - during the past 5 major wars, the markets have rallied an average of 14.2% within the year after a war was started and each war since WWII has seen an ever larger percentage gain following the start of the war. Well, maybe they are all on to something (on they are all on something like Charlie Sheen) about this Libya thing?

Since the recovery officially began in, (cough) June 2009, we have had nothing but positive economic news, similar to today's report on housing which showed sales of existing homes sharply fell (surprise, surprise) while prices dropped to the lowest level in 9 years. At least people living in the tri-state area saw some stabilization, so there's a good excuse to rally the markets.

Not to forget the other good economic news, the EU debt crisis over the weekend once again grabbed the attention as Portugal stepped across the handout line, as the Portuguese gov't is about to disintegrate over the economic situation. One step forward, and three steps back seems to be the way they make progress.

In other financial news, Israel bombed Gaza in retaliation of Gaza launching 50 mortars into Israel. But have no fear, this is no doubt bullish for the economy. Any destruction of homes, businesses, land, resources and even human life means all the more "stuff" that will need to be bought with even more fiat money. More fiat money equals more inflation. More inflation means higher stock prices. There is no further explanation necessary. At this point, even Charlie Sheen knows how this works.

And last but certainly not least, news and links about developments in Japan.

Got s'mores? First, from ZeroHedge - thermal images of the nuclear reactors showing a fairly hot 264 degrees Fahrenheit around reactor 3. This could indicate serious trouble if that is the temp on the outside of the containment vessel.

Next, a newer Geiger counter in Tokyo, updated every 10 minutes is showing some big spikes of radiation coming that way. Could be the wind carrying particles. Nevertheless, long term exposure of these levels can be harmful. A radiation map around the Fukushima plant is showing extremely high levels of radiation over 20 miles from the epicenter. As quoted from a Reuters update - "MP32 is reading 90uSv/h. It has been above 100 for a few days now, with a max of 170uSv/h. Since the Japanese media seem to like the chest x-ray comparison (50uSv each time), you can do the quick math yourself." In other words, right now 20 miles away from the reactors, an individual just standing around (in the "safe to remain indoor zone") could be getting two chest X-rays every hour, on a daily basis. It doesn't take a nuclear scientist to know that can't be good for one's health.

Ever since radioactive rain began falling in Japan, the official levels of what are considered safe have been raised. From Kyodo, "A radiation level of 100,000 counts per minute will be introduced as a new standard for decontamination, up from 6,000 counts per minute, the government said, adding that raising the bar will not endanger health." Feel better now? The next time you drink a whole bottle of NyQuil, call of the FDA and ask them if they could raise the legal safe dosage so you won't need your stomach pumped. That will do the trick.

Further, since "you are what you eat," it goes without saying then, eating radioactive Spinach, drinking Cesium laced water isn't good either. Or is it?

Thank you Banzai7 of ZeroHedge for that picture worth 14.237 Trillion words. Who knew that radiation was good for you? Thank you Ann, you're aglow with keen knowledge of radiation. Now, let me stick my head in the microwave and see if my IQ goes up. I'll be sure to report back tomorrow after a few healthy doses.

Update 1: Some first person raw footage from just a few feet from reactor #3. Great video.

What a difference a week plus a weekend makes when it comes to headline news. Just ten days ago, nearly every TV channel, newspaper and media outlet was covering every grain of radioactive sand found on the beaches from Okinawa to Kinki - today it seems as if there is some sort of media blackout. Indeed, a quick glance at today's headlines from one popular search engine's main page produces March Madness coverage, a death in sports, Tiger Woods' new fling and two popular actresses wearing (gasp!), the same dress! Buried a page or two over under a pile of Charlie Sheen videos, you'll find that radiation levels in food in Japan is much higher than first thought. Ok, so not a total blackout of coverage per se, but it does show how quickly news, no matter how significant, becomes stale. Therefore, out of respect, no mention of the radiation emergency will be mentioned in this post... until at least the 6th paragraph or Charlie Sheen is noted 3 times, whichever comes first.

Warren Buffet today told a group of people in South Korea that the situation in Japan is a "buying opportunity" and this crisis "will not change its economic future." Reading this statement like a Philadelphia lawyer, one could interpret this as "Japan has been in an economic slump for the past 20 years and this won't change that." However, considering his otherwise bullish sentiment about this crisis presenting a buying opportunity, it's very unlikely he meant for you to read between the lines like Charlie Sheen does.

We'll see in the coming months how this all plays out, but I'm going to stick with this a being what it really was/is - a black swan event. Over the next few months, keep in mind the term "multiplier effect." Remember, like a double edged sword, it cuts both ways and as reported here last week, the supply chain disruptions will be difficult to overcome no matter how much money is thrown at this event. Following their logic that this event is bullish, then perhaps they should all hope for more tsunamis. Remember, since that faithful day in 2008, bad news is now good news for the markets. Especially war. War has typically produced gains in the markets. In fact, the markets love wars - during the past 5 major wars, the markets have rallied an average of 14.2% within the year after a war was started and each war since WWII has seen an ever larger percentage gain following the start of the war. Well, maybe they are all on to something (on they are all on something like Charlie Sheen) about this Libya thing?

Since the recovery officially began in, (cough) June 2009, we have had nothing but positive economic news, similar to today's report on housing which showed sales of existing homes sharply fell (surprise, surprise) while prices dropped to the lowest level in 9 years. At least people living in the tri-state area saw some stabilization, so there's a good excuse to rally the markets.

Not to forget the other good economic news, the EU debt crisis over the weekend once again grabbed the attention as Portugal stepped across the handout line, as the Portuguese gov't is about to disintegrate over the economic situation. One step forward, and three steps back seems to be the way they make progress.

In other financial news, Israel bombed Gaza in retaliation of Gaza launching 50 mortars into Israel. But have no fear, this is no doubt bullish for the economy. Any destruction of homes, businesses, land, resources and even human life means all the more "stuff" that will need to be bought with even more fiat money. More fiat money equals more inflation. More inflation means higher stock prices. There is no further explanation necessary. At this point, even Charlie Sheen knows how this works.

And last but certainly not least, news and links about developments in Japan.

Got s'mores? First, from ZeroHedge - thermal images of the nuclear reactors showing a fairly hot 264 degrees Fahrenheit around reactor 3. This could indicate serious trouble if that is the temp on the outside of the containment vessel.

Next, a newer Geiger counter in Tokyo, updated every 10 minutes is showing some big spikes of radiation coming that way. Could be the wind carrying particles. Nevertheless, long term exposure of these levels can be harmful. A radiation map around the Fukushima plant is showing extremely high levels of radiation over 20 miles from the epicenter. As quoted from a Reuters update - "MP32 is reading 90uSv/h. It has been above 100 for a few days now, with a max of 170uSv/h. Since the Japanese media seem to like the chest x-ray comparison (50uSv each time), you can do the quick math yourself." In other words, right now 20 miles away from the reactors, an individual just standing around (in the "safe to remain indoor zone") could be getting two chest X-rays every hour, on a daily basis. It doesn't take a nuclear scientist to know that can't be good for one's health.

Ever since radioactive rain began falling in Japan, the official levels of what are considered safe have been raised. From Kyodo, "A radiation level of 100,000 counts per minute will be introduced as a new standard for decontamination, up from 6,000 counts per minute, the government said, adding that raising the bar will not endanger health." Feel better now? The next time you drink a whole bottle of NyQuil, call of the FDA and ask them if they could raise the legal safe dosage so you won't need your stomach pumped. That will do the trick.

Further, since "you are what you eat," it goes without saying then, eating radioactive Spinach, drinking Cesium laced water isn't good either. Or is it?

Thank you Banzai7 of ZeroHedge for that picture worth 14.237 Trillion words. Who knew that radiation was good for you? Thank you Ann, you're aglow with keen knowledge of radiation. Now, let me stick my head in the microwave and see if my IQ goes up. I'll be sure to report back tomorrow after a few healthy doses.

Friday, March 18, 2011

Japan Finally Raises Emergency Level To 5 On 7 Point Scale While Entire World Has Level at 6 Already; Frantic Efforts Resulted In No Progress; Supply Chain Disruptions Could Lead To Financial Meltdown; No Fly Zone Raises Oil Over $103; Goldman Sachs Cuts 1800; Yemen Uprising; UK Inflation At 4%

Update 1: The owner/operator of the Fukushima nuclear plant, TEPCO is now warning that a "nuclear chain reaction is feared" for reactor number 4. The fact that TEPCO is admitting this is even more so alarming.

On Monday, Japanese authorities stated roughly their reason the entire world outside of Japan declared this situation a 'disaster of colossal proportions' is because of the "time lag" in the information chain. This of particular interest since the the entire world outside of Japan declared the Nuclear Emergency Level at 6 on the International Nuclear and Radiological Event Scale (INES) already several days ago. Now today, a full week into this disaster and several days after a Level 6 was declared by everyone, Japan has finally raised the INES level to a 5 now that their efforts have resulted in "no improvement." We can only assume that once the international community raises the INES level to 7 on the 7 point scale, Japan will follow suit and raise it to a 6. Or not.

For perspective, the scale below represents the INES scale, as per Wikipedia, with 0 being "no significance" and 7 being "major accident" (a la Chernobyl).

Up until today, Japan continued to keep their estimated level of the emergency at level 4, "accident with local consequences." However, now that radiation has officially been detected in other parts of the world including California, albeit low levels of radiation, one has to ponder their definition of local.

Now as "Operation Extension Cord" is attempted multiple times, the Japanese are said to be preparing for "Operation Bury The Mess" a la Chernobyl. As Reuters reports:

"It was the first time the facility operator had acknowledged burying the sprawling 40-year-old complex was possible, a sign that piecemeal actions such as dumping water from military helicopters or scrambling to restart cooling pumps may not work."

Pieces of the puzzle are starting coming together. There is no certainty that the water pumps will even work so there remains only one final option- bury the entire facility in sand and concrete. And as the Daily Mail is reporting, "a senior Japanese minister also admitted that the country was overwhelmed by the scale of the tsunami and nuclear crisis. He said officials should have admitted earlier how serious the radiation leaks were."

Now that is shocking. Nevertheless, as reported here and by many other financial websites, the real fallout will come in the form of the economic impact. The estimates for the cost to the insurers has been in the range of $17-$35 Billion, but in this interconnected, interdependent global economy, even the slightest supply disruption can cause billions of dollars in economic losses around the world. From car parts to iPads, the shutdowns across Japan will negatively impact the global economy no matter how "bullish" some "experts" claim this event will actually be.

Of course, if by "bullish" they mean more endless printing of money in the form of POMO stock market injections, market intervention, etc., then yes, it will be very bullish for stock prices the world over. Perhaps, they should wish for many more disasters, as this will jump start the whole global economic engine. There has even been talk among experts that the crisis in Japan may get them out of a 20 year deflationary economic slump!

Of course, the unintended consequences such as hyperinflation, food riots, social unrest, the widening wealth gap, etc., are to be ignored at all costs. In the midst of the Japanese catastrophe, we should not forget the other catastrophe that is occurring right before your very eyes. In the UK for example, inflation has reached a critical level of 4%, making the inflation rate there higher than in record setting Zimbabwe, which is only at 3%.

In other news, last night the UN approved a No-Fly Zone over Libya, pushing the price of WTI oil back over $103. Shortly after, Libya declares a cease fire. However, live reports are stating that Gaddafi forces have once again resumed their attacks. Since the UN stated they will begin with violent air strikes, it seems this situation will not end well. Then again, many experts will consider this bullish as well for the global economy so put your rally hats on.

As stated in an earlier post, the inflationary pressures around the world will impact developing nations first and this will result in riots and social unrest, as seen in Yemen today where 46 people have been shot dead and a state of emergency has been declared. Coming to a town near you? This is definitely bullish for the global economy.

Another bullish sign that the recovery is in full swing, Goldman Sachs is cutting 5% of its trading desks, or roughly 1,785 people, "due to soft volumes and a pullback in client activity" with "more layoffs coming." That's another 1,785+ people who will now be collecting unemployment benefits and no doubt be celebrating their departure by purchasing a new iPad2.

On Monday, Japanese authorities stated roughly their reason the entire world outside of Japan declared this situation a 'disaster of colossal proportions' is because of the "time lag" in the information chain. This of particular interest since the the entire world outside of Japan declared the Nuclear Emergency Level at 6 on the International Nuclear and Radiological Event Scale (INES) already several days ago. Now today, a full week into this disaster and several days after a Level 6 was declared by everyone, Japan has finally raised the INES level to a 5 now that their efforts have resulted in "no improvement." We can only assume that once the international community raises the INES level to 7 on the 7 point scale, Japan will follow suit and raise it to a 6. Or not.

For perspective, the scale below represents the INES scale, as per Wikipedia, with 0 being "no significance" and 7 being "major accident" (a la Chernobyl).

7 – Major Accident

6 – Serious Accident

5 – Accident With Wider Consequences

4 – Accident With Local Consequences

3 – Serious Incident

2 – Incident

1 – Anomaly

0 – Deviation (No Safety Significance)

Up until today, Japan continued to keep their estimated level of the emergency at level 4, "accident with local consequences." However, now that radiation has officially been detected in other parts of the world including California, albeit low levels of radiation, one has to ponder their definition of local.

Now as "Operation Extension Cord" is attempted multiple times, the Japanese are said to be preparing for "Operation Bury The Mess" a la Chernobyl. As Reuters reports:

"It was the first time the facility operator had acknowledged burying the sprawling 40-year-old complex was possible, a sign that piecemeal actions such as dumping water from military helicopters or scrambling to restart cooling pumps may not work."

Pieces of the puzzle are starting coming together. There is no certainty that the water pumps will even work so there remains only one final option- bury the entire facility in sand and concrete. And as the Daily Mail is reporting, "a senior Japanese minister also admitted that the country was overwhelmed by the scale of the tsunami and nuclear crisis. He said officials should have admitted earlier how serious the radiation leaks were."

Now that is shocking. Nevertheless, as reported here and by many other financial websites, the real fallout will come in the form of the economic impact. The estimates for the cost to the insurers has been in the range of $17-$35 Billion, but in this interconnected, interdependent global economy, even the slightest supply disruption can cause billions of dollars in economic losses around the world. From car parts to iPads, the shutdowns across Japan will negatively impact the global economy no matter how "bullish" some "experts" claim this event will actually be.

Of course, if by "bullish" they mean more endless printing of money in the form of POMO stock market injections, market intervention, etc., then yes, it will be very bullish for stock prices the world over. Perhaps, they should wish for many more disasters, as this will jump start the whole global economic engine. There has even been talk among experts that the crisis in Japan may get them out of a 20 year deflationary economic slump!

Of course, the unintended consequences such as hyperinflation, food riots, social unrest, the widening wealth gap, etc., are to be ignored at all costs. In the midst of the Japanese catastrophe, we should not forget the other catastrophe that is occurring right before your very eyes. In the UK for example, inflation has reached a critical level of 4%, making the inflation rate there higher than in record setting Zimbabwe, which is only at 3%.

In other news, last night the UN approved a No-Fly Zone over Libya, pushing the price of WTI oil back over $103. Shortly after, Libya declares a cease fire. However, live reports are stating that Gaddafi forces have once again resumed their attacks. Since the UN stated they will begin with violent air strikes, it seems this situation will not end well. Then again, many experts will consider this bullish as well for the global economy so put your rally hats on.

As stated in an earlier post, the inflationary pressures around the world will impact developing nations first and this will result in riots and social unrest, as seen in Yemen today where 46 people have been shot dead and a state of emergency has been declared. Coming to a town near you? This is definitely bullish for the global economy.

Another bullish sign that the recovery is in full swing, Goldman Sachs is cutting 5% of its trading desks, or roughly 1,785 people, "due to soft volumes and a pullback in client activity" with "more layoffs coming." That's another 1,785+ people who will now be collecting unemployment benefits and no doubt be celebrating their departure by purchasing a new iPad2.

Thursday, March 17, 2011

Tokyo In Chaos As ATM's Run Dry; Radioactive Japan - Geiger Counter 45 Miles From Fukushima Shows Radiation Off The Dial; Think Radiation Plumes Can't Reach West Coast? Think Again; Yen Goes Stratospheric; Only 16 Seconds of Exposure at Reactors 3 & 4 Needed For Death; Mass Exodus Taking Place; US Now Urges Citizens To Leave Japan; Radiation Measurements Blocked By Japan; Much More

Update 3: Radiation has now officially been detected in Dallas and Chicago. The New York Post via Bloomberg has reported that several passengers arriving from Tokyo have set off security detectors due to radiation.

Update 2: IAEA is reporting that reactors 1, 2, 3 and 4 have suffered severe damage. News is circulating that 20 emergency workers are contaminated.

Update 1: Message from a NAF Atsugi Military Base located near Tokyo- "President Obama has authorized a military evacuation order for all US citizens wanting to leave the country." The video says it all including condition of reactors.

We're now a full 7 days into this catastrophe of "colossal" proportions, and so far despite their best efforts to contain the problems, the situation continues to spiral out of control exponentially. Unquestionably the most telling news of all is from a CNN iReporter, who is on the ground tracking the situation from roughly 45 miles due west of Fukushima with a Geiger Counter; the results are very worrisome. We can only hope he left the area immediately.

Unfortunately, with very dangerous levels of radiation which can kill in 16 seconds now being reported at the Fukushima plant, even particle dilution caused by shifting wind currents can't simply make radiation any less dangerous. Thus, the last ditch effort to use a water canon has failed due to the high levels of radiation.

With those two reports in mind, one must wonder why a Japanese official would even dare to say, "Based on scientific evidence there is absolutely no reason to leave Tokyo." We suppose he graduated from the same "Money over People" school as CNBC's Kudlow.

As previously mentioned in another post, the public continues to receive waves of conflicting information, so the prudent advice to err on the side of caution, has once again proven to be the best course of action. Even the US is having a difficult time deciphering various conflicting reports. Therefore, the US urging its citizens to leave Japan entirely seems the most prudent action to take. Forget the mandatory 50 mile evacuation; they are advising to simply leave Japan due to other mounting problems unrelated to the nuclear emergency, such as infrastructure breakdown and lack of drinking water. Lest you forget - running out of toilet paper can also be a serious problem in a densely populated city such as Tokyo. Many ATM's in the city are out of cash and leading to further panic.

One thing is becoming clearer, however. More experts, from Sweden to Germany, are agreeing that radiation could reach the West Coasts of Canada, the US and Mexico. The New York Times has a useful interactive weather map tracking and forecasting the radioactive plumes. Also previously posted but worth noting is the radiation map for the US. Fortunately, the experts report that the levels should pose no danger to your health, yet. Then again, since radioactive particles are cumulative, is there any amount that is really safe?

Not to be overlooked are the financial repercussions of this fallout. First, as if Japan's economy won't suffer enough from this disaster, last night's FX markets saw the Yen go stratospheric, making all time highs and seeing it's largest trading partner go down in flames. The USDJPY hit the unprecedented 76 level. If Japan was counting on exports to the US to be the White Knight in shining armor, they can now count that out. "Calling all Martians! Bring money to earth!"

The timing of this earth changing event could not have come at a better time for the Federal Reserve, as the attention has been shifted away from the disaster occurring right here in this country. Total US debt has hit $14.237 Trillion, just a few billion away from the ceiling. But

But if there is anything positive to come out of this economically, it is in the sales of Potassium Iodide, which is now officially sold out in the US. Further, the US is rumored to have taken control of all Ki. Time will tell if your $16 investment a few days ago could turn into a new car. Now that deserves a fist pump.

More updates soon.

Wednesday, March 16, 2011

Rumors And (Botox) Injections; EU Declares "Situation Out Of Control"; Tokyo Now Ghost Town; Raising Legal Limit For Radiation

Update 4: A series of earthquakes has been occurring over the past several hours in some unusual places, including Russia, Idaho and Ontario Canada. As you can see, California pops up on the map quite often with many common 1.1 magnitude quakes, but given the recent activity in the "ring of fire" starting in New Zealand, up into Japan, could the West Coast be next? Per update 1 today, let's hope not.

Update 3: Japanese Science Ministry now saying "levels of radiation are too low to present health problems" in some areas- which seems contradictory to the latest US evacuation orders of 50 miles. Below in the link section is a link for "Radiation Explanation."We don't think anyone wants to take the chance that even "low levels of radiation" are safe.

Update 2: US embassy alerting all US citizens to evacuate all areas within 50 miles of Fukushima now that at least a partial meltdown is confirmed. This is especially interesting since the Japanese gov't has kept their 12 mile mandatory evacuation in place and has not changed that order; no doubt, upping the mandatory evacuation will create anger and discredit the "official" information further.

Update 1: It's official. The US can't help Japan monetarily. According to CNN, former US comptroller David Walker said "the U.S. has little or no budget to deal with unexpected catastrophic events." In other words, let's hope there are no major disasters in the US in the next 50 years or else we'll be asking Martians for help.

Yesterday, a rumor began to circulate around trading desks that said the Japanese stock market would be closed for the remainder of the week, no doubt due to the high levels of volatility (and radiation) and the 17% stock market plunge in the two days that followed this ongoing catastrophe. Soon after that rumor began, an official report was released to the public stating the markets would remain open. Piecing the puzzle together, one could get a glimpse of one possible scenario that went like this:

Shortly after the closing bell in Japan on Tuesday, an emergency meeting was held to discuss what to do with falling stock prices since the two days worth of $200 Billion in injections from the Bank of Japan failed to stop the decline in the NIKKEI. After several hours of discussions, officials decided it was best to close the market for the week and allow things to cool down (no pun intended). This action has been implemented many times around the world during times of crisis and has proven to work effectively. However, that decision was later canceled because it was thought a full closure for the market might make people more nervous and bring about further panic (remember, their goal is to keep the illusion of continuity no matter what). However, doing that might be counterproductive given the near certainty the markets would continue to decline. Therefore, once again tearing a page directly from Dr. Deficit's playbook, the BoJ decides to pump another $500 Billion (Billion with a capital "B" for a total of $700 Billion) into the markets and Presto! Et viola! Like magic, the NIKKEI manages to rally 5% in the midst of a rapidly deteriorating situation. As per Reuters, "Japan's nuclear crisis appeared to be spinning out of control on Wednesday."

Which is all the more interesting since the World Health Organization issued this statement: "Governments and members of the public are encouraged to take steps to halt these rumours, which are harmful to public morale."

We can only suppose by "rumours" they mean anything, like the aforementioned article from Reuters that goes contrary to official statements from the Chief Cabinet Secretary that say "People would not be in immediate danger if they went outside with these levels. I want people to understand this."

On one side, the official report from Japan states "this is no Chernobyl" and on the other, the EU's Energy Commissioner is now saying "the situation at Japanese reactor is effectively out of control."

As you can see, during major catastrophes like this, it is difficult to determine who can be believed. However, it may be prudent to keep in mind the cliche about throwing out questionable food- "When in doubt, throw it out." Adjusted for this event, "When in doubt, get out." As can been seen from video of Tokyo, many people are doing just that and erring on the side of caution.

Further helping to show which side of the coin is better -- because it is a fact that radiation levels are on the rise, what else can the Japanese gov't do but raise the "legal radiation dose" for workers. Feeling radiation sickness? There all better now. The maximum "safe" limit has just been raised. You should feel better immediately. As another excellent site says, "When All Else Fails, Change The Rules."

Another day, another tsunami of news items. Let's begin with some excellent links.

Latest images of Fukushima from the side of the plant not often seen.

Map showing radiation levels across Japan.

Updates on Fukushima #2 reactor.

Radiation Explanation

An excellent Q&A from Reuters on risks at each reactor can be found here.

An eye on radiation levels in the US.

Live stream from Japan news.

More links being added.

Check back often for updates.

Update 3: Japanese Science Ministry now saying "levels of radiation are too low to present health problems" in some areas- which seems contradictory to the latest US evacuation orders of 50 miles. Below in the link section is a link for "Radiation Explanation."We don't think anyone wants to take the chance that even "low levels of radiation" are safe.

Update 2: US embassy alerting all US citizens to evacuate all areas within 50 miles of Fukushima now that at least a partial meltdown is confirmed. This is especially interesting since the Japanese gov't has kept their 12 mile mandatory evacuation in place and has not changed that order; no doubt, upping the mandatory evacuation will create anger and discredit the "official" information further.

Update 1: It's official. The US can't help Japan monetarily. According to CNN, former US comptroller David Walker said "the U.S. has little or no budget to deal with unexpected catastrophic events." In other words, let's hope there are no major disasters in the US in the next 50 years or else we'll be asking Martians for help.

Yesterday, a rumor began to circulate around trading desks that said the Japanese stock market would be closed for the remainder of the week, no doubt due to the high levels of volatility (and radiation) and the 17% stock market plunge in the two days that followed this ongoing catastrophe. Soon after that rumor began, an official report was released to the public stating the markets would remain open. Piecing the puzzle together, one could get a glimpse of one possible scenario that went like this:

Shortly after the closing bell in Japan on Tuesday, an emergency meeting was held to discuss what to do with falling stock prices since the two days worth of $200 Billion in injections from the Bank of Japan failed to stop the decline in the NIKKEI. After several hours of discussions, officials decided it was best to close the market for the week and allow things to cool down (no pun intended). This action has been implemented many times around the world during times of crisis and has proven to work effectively. However, that decision was later canceled because it was thought a full closure for the market might make people more nervous and bring about further panic (remember, their goal is to keep the illusion of continuity no matter what). However, doing that might be counterproductive given the near certainty the markets would continue to decline. Therefore, once again tearing a page directly from Dr. Deficit's playbook, the BoJ decides to pump another $500 Billion (Billion with a capital "B" for a total of $700 Billion) into the markets and Presto! Et viola! Like magic, the NIKKEI manages to rally 5% in the midst of a rapidly deteriorating situation. As per Reuters, "Japan's nuclear crisis appeared to be spinning out of control on Wednesday."

Which is all the more interesting since the World Health Organization issued this statement: "Governments and members of the public are encouraged to take steps to halt these rumours, which are harmful to public morale."

We can only suppose by "rumours" they mean anything, like the aforementioned article from Reuters that goes contrary to official statements from the Chief Cabinet Secretary that say "People would not be in immediate danger if they went outside with these levels. I want people to understand this."

On one side, the official report from Japan states "this is no Chernobyl" and on the other, the EU's Energy Commissioner is now saying "the situation at Japanese reactor is effectively out of control."

As you can see, during major catastrophes like this, it is difficult to determine who can be believed. However, it may be prudent to keep in mind the cliche about throwing out questionable food- "When in doubt, throw it out." Adjusted for this event, "When in doubt, get out." As can been seen from video of Tokyo, many people are doing just that and erring on the side of caution.

Further helping to show which side of the coin is better -- because it is a fact that radiation levels are on the rise, what else can the Japanese gov't do but raise the "legal radiation dose" for workers. Feeling radiation sickness? There all better now. The maximum "safe" limit has just been raised. You should feel better immediately. As another excellent site says, "When All Else Fails, Change The Rules."

Another day, another tsunami of news items. Let's begin with some excellent links.

Latest images of Fukushima from the side of the plant not often seen.

Map showing radiation levels across Japan.

Updates on Fukushima #2 reactor.

Radiation Explanation

An excellent Q&A from Reuters on risks at each reactor can be found here.

An eye on radiation levels in the US.

Live stream from Japan news.

More links being added.

Check back often for updates.

Tuesday, March 15, 2011

Breaking News: Radiation Levels Spark Panic, Evacuations In Tokyo; Accident Upgraded to Level 6 of 7; Airlines Cancel All Flights Into Tokyo; Fukushima Plant Now Abandoned; 10yr Bond Yield Crashes; US Treasury Runs Dry; Nikkei Crashes; Rule 48 Invoked

Update 4: No need to panic (yet), but CNN has reported nuclear fallout radiation could indeed reach Canadian and US coasts. Got potassium iodide? Price gougers on eBay are selling single packages which normally retail for $20, for the absurdly low price of just $1,625 + $50 for shipping. You can't make this up.

Update 3: Mass evacuations are taking place throughout northern Japan with scores of foreigners booking any last minute flights they can find. Some residents are not even sure if they will need to ever use the return flight ticket. You can be certain this will be spun into positive news for the markets.

Update 2: Officials have now just stated the Japanese Stock Exchange will operate as usual tomorrow. That being said, don't be surprised if there are "margin issues" that halt trading if stock prices drop another 5-10%. With the Fed stating today that they will continueendless money printing supporting the markets, expect to see surprise rallies in the wake of the most devastating disaster to hit the global markets since WWII.

Update 1: There is a rumor now circulating that the NIKKEI will remain closed for the remainder of the week on "Margin Issues," which should be translated as "we're afraid the stock market will continue to drop and we can't have that." As soon as this is confirmed, I will update this post. Until then, it's just more bread and circuses.